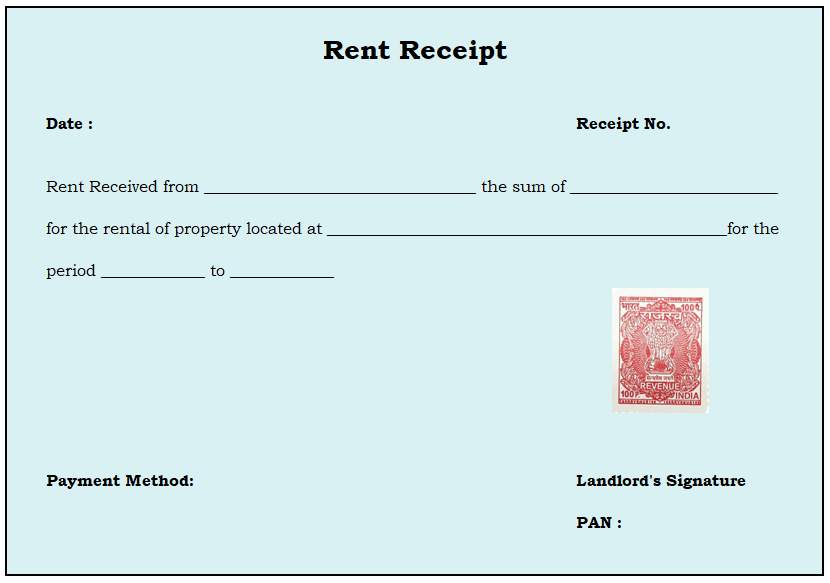

Rent Receipt Format with Revenue Stamp for HRA & Tax Proof

Published on: June 21, 2025

A rent receipt is a document provided by a landlord to a tenant as proof of rent payment, serving as a record of financial transactions for tracking payments, maintaining financial records, and fulfilling legal and taxation requirements.

Rent Receipt Guide

Create a Rent Receipt in a Few Steps

1. Fill in the necessary details:

- Name

- Monthly rent amount

- Address of rented house

- PAN number

- Period of rent paid

2. Get rent receipt stamped & signed by landlord.

3. Submit rent receipts to the employer to claim the HRA exemption.

Importance of Rent Receipts

- Rent receipts serve as legally recognized proof of rent payment, a crucial financial record for landlords and tenants, and are essential for claiming rental expenses for tax purposes and HRA tax deductions.

- It holds landlords accountable for providing a documented record of rent transactions, promoting transparency in the landlord-tenant relationship.

- It also acts as evidence in case of any disagreements or disputes related to rent payments, providing a clear trail of financial transactions.

Details Required in Rent Receipts

1. Tenant’s name

2. Landlord’s name

3. PAN of the landlord

4. Rent amount

5. Payment date

6. Rent period

7. Rented property address

8. Revenue stamp (if required)

9. Landlord’s signature

Revenue Stamp

A revenue stamp is a small, adhesive label that indicates payment of taxes or fees. It’s often required for documents like agreements, deeds, or receipts to indicate that the necessary financial obligations have been fulfilled.

Is Revenue Stamp Mandatory?

- If Cash payment > ₹5,000: Yes

- If Cash payment ≤ ₹5,000: No

- If Online transfer/Cheque: No

Tax Savings through Rent Receipts

Claim HRA exemption under Section 10(13A) of the Income Tax Act.

The exemption is the least of:

- Actual HRA received

- 50% of salary (metro cities) or 40% of salary (non-metro cities)

- Rent paid minus 10% of salary

FAQs

What if the landlord refuses to provide a rent receipt?

Communicate with the landlord and explain the importance.

What if the landlord doesn't have a PAN?

Furnish a written declaration if the annual rent exceeds ₹1 lakh.

Do I need a rent receipt for HRA benefits?

Yes, it's required as proof of rent payment.